The Story That Shocked Wall Street

In 2021, the GameStop (yahoo finance gme) stock became a symbol of the power of retail investors. What started as a niche group of traders on Reddit’s WallStreetBets exploded into a global financial phenomenon. The story behind GME was more than just a stock rally—it was about challenging Wall Street, hedge funds, and institutional investors.

Yahoo Finance, one of the most influential financial news platforms, provided extensive coverage of the GME saga. This article explores the role Yahoo Finance played in reporting on the rise, fall, and continuing saga of GameStop, alongside an in-depth look at the financial implications of the GME short squeeze.

Why Yahoo Finance?

yahoo finance gme is not just a news outlet; it is a critical platform for retail investors, traders, and financial professionals. With its timely reporting, comprehensive analyses, and interactive charts, it is the go-to resource for stock-related information. For retail investors following GME’s rise, Yahoo Finance played a pivotal role in keeping them informed, updated, and aware of key events.

But what made yahoo finance gme coverage of GME special? How did the platform report on one of the most unprecedented stock surges in history?

- What is GME (GameStop)?

The Retail Giant in a Digital Age

GameStop, a video game retailer, was founded in 1984 and became a staple in shopping malls across America. However, with the rapid digitalization of gaming and the rise of digital platforms like Steam and Xbox Live, GameStop’s traditional business model began to show signs of wear. By 2020, the company was struggling, and many investors believed it was on the verge of collapse.

In early 2021, GameStop became the subject of a dramatic stock price surge driven by retail investors. The company, once considered on the brink of bankruptcy, found itself at the center of a financial storm that led to the phenomenon known as the “short squeeze.”

GameStop’s Short Squeeze Explained

A short squeeze happens when a stock that is heavily shorted (betting that its price will fall) unexpectedly rises in value. Hedge funds had heavily shorted GME stock, betting that it would continue to decline. However, retail investors, fueled by discussions on Reddit and other social platforms, started buying the stock, causing its price to skyrocket.

As the stock price rose, short-sellers were forced to buy back the shares they had borrowed to cover their positions, driving the yahoo finance gme price even higher. This event put GameStop in the spotlight and highlighted the growing influence of retail investors in the financial markets.

- Yahoo Finance: A Snapshot of Its Influence in Market Coverage

The Power of Yahoo Finance in the Financial World

Yahoo Finance is one of the most yahoo finance gme visited financial news websites in the world, offering up-to-the-minute stock quotes, market news, and in-depth analysis. It serves as a key resource for both professional investors and casual traders. The platform covers a wide range of financial topics, including stocks, commodities, cryptocurrencies, personal finance, and more.

For investors looking for a quick yet comprehensive look at the market, Yahoo Finance is the first stop. It not only offers news articles and market reports but also provides interactive tools such as stock screeners, live market data, and yahoo finance gme portfolio tracking. Its accessibility and wealth of information have made it a trusted platform for investors worldwide.

The Role of Yahoo Finance During the GME Short Squeeze

When the GME stock started to surge, Yahoo Finance became a crucial resource for many retail investors trying to make sense of what was happening. The platform offered real-time data and in-depth analyses of GameStop’s stock movements, which were essential for investors looking to capitalize on the volatility.

Moreover, Yahoo Finance’s coverage was not just about reporting price movements; it was about understanding the market dynamics behind the GME rally. From interviews with experts to breakdowns of hedge fund strategies, Yahoo Finance yahoo finance gme provided critical insights into the short squeeze.

- How Yahoo Finance Covered the GME Stock Short Squeeze

Real-Time Updates: A Vital Source of Information

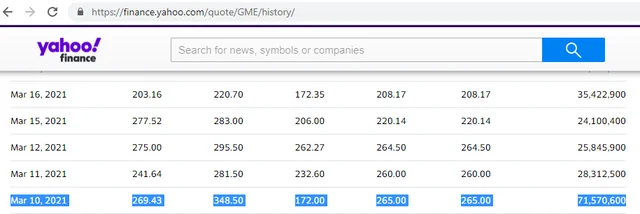

As GME stock began its meteoric rise, Yahoo Finance provided continuous updates. The platform tracked the stock’s performance throughout the day, yahoo finance gme allowing investors to follow the action live. With GME’s share price soaring from under $20 to over $400 in a matter of days, Yahoo Finance’s live data feeds kept traders informed about the stock’s volatility.

In addition to live coverage, Yahoo Finance offered analysis pieces that explored the mechanics behind the short squeeze. These articles explained how hedge funds were betting against GameStop and the role retail investors played in driving the stock yahoo finance gme price upward. The coverage was comprehensive, providing both context and analysis to help investors make informed decisions.

Expert Opinions and Interviews

One of Yahoo Finance’s key strengths is its ability to bring in experts from various fields of finance. During the GME saga, the platform interviewed analysts, financial experts, and even retail investors who were involved in the short squeeze. These interviews yahoo finance gme provided unique perspectives on the situation, offering readers a deeper understanding of the financial and emotional drivers behind the GME rally.

Yahoo Finance also provided expert opinions on the risks associated with investing in highly volatile stocks like GME. These experts warned of the dangers of chasing a “meme stock” and encouraged investors to consider the long-term fundamentals of any company before making investment decisions.

Breaking News and Market Reactions

As the GME short squeeze unfolded, Yahoo Finance was quick to report breaking news. For example, when the major trading platforms like Robinhood restricted trading on GameStop, Yahoo Finance was at the forefront of reporting the event. This was a yahoo finance gme pivotal moment in the GME saga, as it raised questions about market manipulation and the role of brokerage firms in restricting trades.

Yahoo Finance’s coverage of these developments helped retail investors stay updated on the key events that were shaping the GME story. The platform also examined the broader implications of these events, including potential regulatory changes and the future of online trading platforms.

- The GME Phenomenon: A New Era of Retail Investors

The Rise of Retail Investors

Before the GME saga, the stock market was often seen as the domain of institutional investors, hedge funds, and professional traders. Retail investors yahoo finance gme were typically regarded as outsiders, often reacting to trends rather than shaping them. However, the GME short squeeze changed this perception. Retail investors, driven by discussions on platforms like Reddit and Twitter, played a central role in pushing GameStop’s stock price to astronomical heights.

The GME phenomenon is often seen as the culmination of a growing trend in the democratization of financial markets. With the rise of zero-commission trading platforms like Robinhood and the widespread availability of financial information online, retail yahoo finance gme investors now have access to the same tools and information as institutional investors.

The Power of Social Media in Financial Markets

Social media played a significant role in the rise of GME. Platforms like Reddit’s WallStreetBets, Twitter, and YouTube became central hubs for sharing information, rallying behind GameStop, and coordinating buying strategies. The GME rally was fueled by a collective effort to challenge the establishment, and social media allowed retail investors to coordinate their actions in real-time.

Yahoo Finance, in its coverage, acknowledged yahoo finance gme the role of social media in driving the GME surge. The platform reported on the growing presence of retail investors in financial markets and examined how social media can influence stock prices. This new era of retail investing has reshaped the financial landscape, and platforms like Yahoo Finance continue to track these developments.

- The Role of Social Media in Driving GME’s Surge

Reddit and the WallStreetBets Community

The WallStreetBets subreddit became the epicenter of the GME rally. What started as a forum for discussing high-risk stock trades turned into a battleground between retail investors and Wall Street institutions. Users on WallStreetBets discussed how they could collectively buy up GME stock to force a short squeeze, leading to a massive surge in GameStop’s price.

Yahoo Finance covered these developments closely, highlighting the role that social media communities like WallStreetBets played in shaping market movements. The platform analyzed how Reddit threads and social media posts can spark buying frenzies and yahoo finance gme create volatility in the stock market.

Twitter and Influencers

While Reddit was the primary platform for the GME discussion, Twitter also played a crucial role. Influential figures, including retail investors and even celebrities, began tweeting about GameStop. These tweets, often with humorous or sarcastic undertones, helped bring attention